Contents:

Last month the Cyprus-based retail brokerage recorded $3.06 trillion in total trading volume. The numbers rose by 8.2%, compared to Januarys $2.82 trillion. The Feds balance sheet through Wednesday, released today, shows to what extent the Fed has provided emergency loans at around 4.75% interest and against collateral to US banks; … U.S. shareholders of Credit Suisse Group AG sued the Swiss bank on Thursday, claiming that the bank defrauded them by concealing problems with its finances. The proposed class action accuses Credit Suisse of deceiving investors by failing to disclose that it was suffering from significant customer outflows, and that it had material weaknesses in its …

We will help you to catch the best market opportunities and the proper knowledge about markets. At the top of our Forex trading calendar, choose the most convenient time zone. In Russia, interest rate decisions are taken by the Central Bank of the Russian Federation. From September 16th of 2013, the official interest rate is the one-week auction repo rate. Until September 15th of 2013, the official interest rate was the refinancing rate, which was seen as a ceiling for borrowing money and a benchmark for calculating tax payments. The activity index of the tertiary industry helps to understand an overall picture of industrial activities, inclusive of all business categories in the tertiary industry.

Commodity News

In Euro Area, the core inflation rate is calculated using the weighted average of the Harmonised Index of Consumer Price aggregates, excluding energy, food, alcohol & tobacco that face volatile price movements. In China, foreign direct investment refer to the accumulated foreign investment in domestic companies or entities in non financial sector in a given year. Morgan Stanley now sees ECB delivering a 25 BPS interest rate hike in May vs prior estimate of 50 BPS.

Relatively less likely to force major market moves except on outsized surprises. Needs to review the security of your connection before proceeding.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. How Central Banks Impact the Forex Market Discover how policies and interest rate hikes of central banks impact forex and trading decisions. Our forex economic calendar is fully customizable, helping you keep track of the exact data you’re interested in. Select specific time zones and currencies of interest and apply filters to refine results and fit your strategy. First Republic Bank, the latest casualty in the ongoing banking turmoil, said it has secured around $30 billion funding from America’s 11 largest banks as a lifeline, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo. Following the news, the bank’s stock, which has been sinking since last week, gained around 10% on Thursday from the previous day’s close.

There are no events scheduled.

References to Forex.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries. The real-timeEconomic Calendarcovers financial events and indicators from all over the world. The Real-time Economic Calendar only provides general information and it is not meant to be a trading guide. FXStreet commits to offer the most accurate contents but due to the large amount of data and the wide range of official sources, FXStreet cannot be held responsible for the eventual inaccuracies that might occur.

Of special interest are the Federal Reserve decisions, usually announced by Governor Jerome Powell. Values before the actual data is released, but be careful – forecasts are always preliminary and actual figures might be drastically different. In Australia, new home sales are based on the survey results obtained from State-wide estimates using weights based on financial year market shares of private dwelling commencements. Most analysts are expecting the European Central Bank to raise the main refinancing rate by 50 basis points to 3.5%, keeping up the 50-bps hiking pace for the third consecutive month. Since the ECB’s last meeting, Eurozone data has been mostly positive and core inflation rose to a fresh record high of 5.6%, even if headline CPI eased a tad to 8.5%.

Using the Economic Calendar

So far my experience with this app is awesome, though I know that Ads is a way of balancing your expenses since the app is free, but please reduce it a bit. That’s all, the app releases information on time and is user friendly. Safety starts with understanding how developers collect and share your data.

The Real-time Economic Calendar may also be subject to change without any previous notice. The economic calendar includes information about major economic events, as well as political news and the impact they have on the Forex market. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information.

The ECB decision was important as it offered a first indication of what the banking stress meant for the monetary policy. As the market mood continues to improve on easing concerns over a deepening financial crisis toward the end of the week, the US Dollar is having a tough time staying resilient against its major rivals. Eurostat will release February inflation data in the European session. Later in the day, the University of Michigan’s Consumer Sentiment Survey and the US Federal Reserve’s Industrial Production data for March will be looked upon for fresh impetus.

- The information on this web site is not targeted at the general public of any particular country.

- In Euro Area, the core inflation rate is calculated using the weighted average of the Harmonised Index of Consumer Price aggregates, excluding energy, food, alcohol & tobacco that face volatile price movements.

- The Economic calendar will help you prepare from minor to major news events and control risk in your Forex trading.

A light grey horizontal line shows you where we stand at the moment and below that line go all upcoming data. Time left before next release is indicated so you quickly grasp when this is coming. When a new data is released, the calendar page is automatically refreshed so you do not miss it. If you want, you can enable a sound notification for all releases. From FBS analysts to learn more about the current trading news events and how they will affect your Forex trading.

Experience our FOREX.com trading platform for 90 days, risk-free. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs. Trade with a market leader and stable partner invested in your success. Take control of your trading with powerful trading platforms and resources designed to give you an edge.

Join the hundreds of thousands of other traders already using our app. With only the U.S. preliminary UoM consumer sentiment report on the docket, you can bet that traders will continue to price in their global banking concerns . Sometimes the number of current economic events can be overwhelming. So, first of https://day-trading.info/ all, make sure to use filters to see the most relevant indicators for your Forex trading. For example, you can choose currencies that you are planning on trading or the indicator impact. Our Economic calendar will show you any scheduled economic events and their results in real-time, counting down to each one.

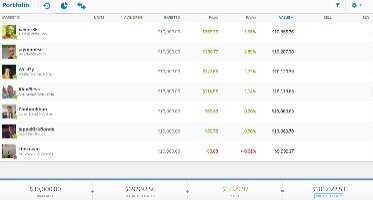

U.S. Dollar Falls As Bank Worries Recede

My only complaint is that you cannot change what the widget and chart shows you. You can only see %gain when I want to see how much $ money I have made from each account everyday. Seems like a simple fix and it would make tracking my account so much easier. I don’t use much else on the app so I can’t speak to that but it is nice to have your entire portfolio in one tracking app. Please rate us and provide feedback so we can enhance the Myfxbook app even further – contact us at But if we see profit-taking or risk aversion in the next couple of hours, then AUD/USD could dip back down to the .6680 or .6660 previous areas of interest.

I understand that residents of my country are not be eligible to apply for an account with this FOREX.com offering, but I would like to continue. Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy. Historically less market-moving event except in the most extraordinary of circumstances. Forex quotes reflect the price of different currencies at any point in time. You can learn more about our cookie policy here, or by following the link at the bottom of any page on our site. Multi-asset broker Exness has released its financial results for February 2023, witnessing an increase in trading demand, as well as in the number of active clients on the platform.

What is the Economic Calendar?

AUD/USD took full advantage of the risk-friendly vibe and was one of the biggest winners of today’s Asian session. AUD, in particular, steadily gained ground and revisited a lot of its intraweek highs againts its major counterparts ahead of the European session open. A lack of fresh catalysts kept the major currencies in tight ranges until about midway through the Asian session when risk-taking dominated the headlines. Regional bank First Republic Bank received $30B lifeline from a group of large U.S. banks including Bank of America, JP Morgan, and Citi to help stabilize depositor base. ECB raised interest rates by 50bps as expected and is going “data-dependent” going forward. Philadelphia Fed manufacturing index improved from -24.3 to -23.2 in March, but missed -15.6 estimates and marked its seventh consecutive negative reading.

European shares rose on Friday to extend gains from the previous session as multi-billion-dollar lifelines for troubled U.S. and European banks helped calm investor fears around potential contagion. As stress ripples through smaller banks in the U.S., the tightening in lending standards among those institutions is expected to reduce economic growth this year, according to … Using the mobile app allows you to view the market, use tools, etc. Please note that our technology is constantly evolving and requires development costs, thus, we have ads or a yearly subscription to hide the ads. This helps us cover the costs, the subscription is not required to use the app’s features. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. Euro has failed an attempt to mount yearly-open resistance and threatens a deeper pullback in the days ahead. From a trading standpoint, look to reduce short-exposure / lower protective stops on a stretch towards the 1.04-handle – rallies should be limited to 1.07 IF price is heading lower. I’ll publish an updated Euro short-term technical outlook once we get further clarity on the near-term EUR/USD technical trade levels. Euro plunged more than 1.8% off the weekly highs with EUR/USD reversing sharply off confluent resistance at the yearly open.

In this article, I am going to give a basic introduction to insolvency , as well as a discussion of the principles of how losses are apportioned to the various classes of creditors of American banks. definition of « base currency » in forex trading I will only attempt to look at American banks since bankruptcy procedures are specific to each legal jurisdiction. Breaking news is defined as new information that has market-moving potential.

While the broader outlook is still technically constructive, the threat of a deeper correction within the broader advance remains while below the 1.07-handle. These are the updated targets and invalidation levels that matter on the EUR/USD weekly technical chart heading into tomorrow’s European Central Bank interest rate decision. Unemployment figures, company earnings reports and elections – keep track of key announcements and other events that could affect the markets. Stay informed with real-time market insights, actionable trade ideas and professional guidance.

These inflation readings are way too high for ECB to be comfortable. Trade 5,500+ global markets including 80+ forex pairs, thousands of shares, popular cryptocurrencies and more. Overall, data for Chinas economic performance at the start of 2023 are quite mixed. Despite the reopening (since China abandoned its zero-COVID policies in early December), there …

The composite index is a general indicator in which the indexes to express the activity in respective business categories are consolidated with weight in terms of the scale of relative importance of each business category . You can set up an individual notification for each and every economic event which will send you an email notification at the pre-determined time interval. UK wages including bonuses have been stuck around 6% annual pace in nominal terms for several months. But annual CPI has been around 10%, meaning that real wages have fallen as the cost-of-living crisis has deepened. This data release could certainly sway the MPC’s vote at the next meeting. BoE Governor recently said that “some further increase in Bank Rate may turn out to be appropriate, but nothing is decided. »