Contents:

If the fees do not meet the above requirements, report them on line 8z of Schedule 1 . If you administer a deceased person’s estate, your fees are reported on Schedule C if you are one of the following. You are engaged in one of the following trades or businesses.

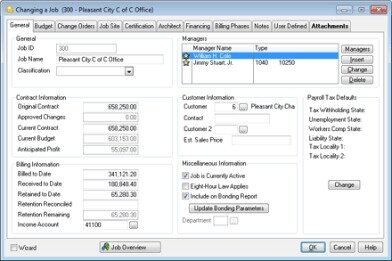

After you create or update relationships between pairs of value sets, make sure the chart of accounts structure is successfully redeployed. For example, you have Company and Division segments in your chart of accounts. The company US East has transactions in only the Car and Truck divisions, while the company US West deals with only the Motorcycle and Car divisions. You can define relationships between the Company and Division segments to enforce the relationships between their segment values. Use related value sets to define dependencies between two segments in a chart of accounts to ensure that only valid combinations are used during data entry.

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

You receive money as a tenant for the cancellation of a lease. Generally, you must use Form 3115 to request an automatic change. Activities subject to the uniform capitalization rules. The liability can be determined with reasonable accuracy. A fiscal tax year is 12 consecutive months ending on the last day of any month except December.

Statewide Consolidated District Financial Databases

To claim a general business credit, you will first have to get the forms you need to claim your current year business credits. This credit is a nonrefundable tax credit for an eligible small business that pays or incurs expenses to provide access to persons who have disabilities. You must pay or incur the expenses to enable your business to comply with the Americans with Disabilities Act of 1990.

The next step up is the Growing plan for $34 per month, which includes unlimited bank transaction reconciliations, invoices, bills, and receipts. The top-tier plan is the Established plan, which costs $65 per month and also includes multi-currency reports, expenses, and project management. For more information on specific plans and pricing, contact Xero online. Xero is a cloud-based small business accounting program that’s often considered as an alternative to QuickBooks Online. It was founded in 2006 in New Zealand and is used around the world.

Publication 334 – Additional Material

Live setup assistance and ongoing tech support are included. If you live in one of the states that offer on-time sales tax discounts, DAVO will pass that on to you. We chose ZIpBooks as our accounting software for restaurants with the best price because it offers a free option, which is great if you want to try it out or only need limited features.

For the purpose of constructing or improving qualified long-term real property for use in your business at that retail space. Consignments of merchandise to others to sell for you are not sales. The title of merchandise remains with you, the consignor, even after the consignee possesses the merchandise.

Relax—run payroll in just 3 easy steps!

It is similar to the social security and Medicare taxes withheld from the pay of most wage earners. You can review each software provider’s criteria for free usage or use an online tool to find which free software products match your situation. Some software providers offer state tax return preparation for free. You can check the status of your refund if it has been at least 24 hours from the date you filed your return. Be sure to have a copy of your tax return available because you will need to know the filing status, the first SSN shown on the return, and the exact whole-dollar amount of the refund. Form W-4, Employee’s Withholding Allowance Certificate, is completed by each employee so the correct federal income tax can be withheld from their pay.

They also include a part of the wages you pay to employees who work directly on the product part time if you can determine that part of their wages. You can elect to exclude the cancellation of qualified real property business debt. If you make the election, you must reduce the basis of your depreciable real property by the amount excluded. Make this reduction at the beginning of your tax year following the tax year in which the cancellation occurs. However, if you dispose of the property before that time, you must reduce its basis immediately before the disposition.

If you earned income as a statutory employee, you do not pay SE tax on that income. Social security and Medicare tax should have already been withheld from those earnings.. SE tax is a social security and Medicare tax primarily for individuals who work for themselves.

Also, Inquire about the terms you can and cannot negotiate with the bank where you have a savings account. Finally, you should also consider the speed of transactions and the banks’ track record. Remember that a separate bank account is legally required for any company registered as an LLC or partnership. Even if you operate as a sole owner, having a different account can help you maintain the accuracy of your financial records. A chart of accounts is significant because it is intended to segregate expenditures, revenue, assets, and liabilities, giving a company a clear idea and picture of its financial health.

Additionally, what is great is you can run payroll through Square as well. Thecustomer is going to want something that is extremely easy to pay and tip on. They are going to want to have simple electronic methods of payments. The owner wants a system that is easy to program, enter orders, accept payments, and extract information into their accounting system.

It takes data from your POS and can automate your sales tax in as little as five minutes. It doesn’t include payroll services or some of the features available in other accounting software, so you may want to use it in addition to one of the other software options. It can be downloaded on your POS or used from the site. We chose TouchBistro as the best option for food truck owners because it’s an iPad system that’s portable and can be operated easily on a truck’s wifi. It’s also easy to set up, can be integrated with different systems, and offers robust features specific to food truck owners. However, if you need in-depth accounting services, you will need to integrate with QuickBooks or choose another restaurant accounting software.

Off QuickBooks

You cannot deduct expenses in advance, even if you pay them in advance. This rule applies to any expense paid far enough in advance to, in effect, create an asset with a useful life extending substantially beyond the end of the current tax year. If you take out a policy on your life or on the life of another person with a financial interest in your business to get or protect a business loan, you cannot deduct the premiums as a business expense. Nor can you deduct the premiums as interest on business loans or as an expense of financing loans.

Reconciling accounts keeps you aware of lost checks, incorrect deposits, or cash variances. Account reconciliation also catches accounting errors and keeps track of your transactions. Your accountant or bookkeeper will reconcile all bank accounts, payroll liabilities, credit accounts, loans, lines of credit, and financing sources.

The Complete Guide to SBA 7(a) Loans in 2022 – Funding Circle

The Complete Guide to SBA 7(a) Loans in 2022.

Posted: Mon, 19 Sep 2022 07:00:00 GMT [source]

The Professional loan amortization is the top-tier option and costs $489 per location per month. It includes scheduling, inventory, and accounting features, as well as labor, analytics, and custom financial reports. Restaurant365 is an accounting software program that combines bookkeeping with restaurant management tools like invoicing, ordering, and staff scheduling. It doesn’t offer payroll services but can be integrated with the payroll company ADP.

For details about damaged, destroyed, or stolen https://bookkeeping-reviews.com/, see Pub. For details about other dispositions, see chapter 1 of Pub. Your office supplies may qualify as a recurring expense. In that case, you can deduct them in 2022 even if the supplies are not delivered until 2023 . You can deduct an expense you pay in advance only in the year to which it applies.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

It is also easily integrated with vendors, POS systems, and financial institutions for automated banking reconciliation. Accounting software is used by businesses to track income and expenses. Restaurants use it to do many of the same things, but it can also help track inventory, create invoices, calculate sales tax, price recipes and menus, and integrate with point of sales systems. If you are operating a food truck you are running a business and therefore you will have normal operating expenses just like every other business. I really encourage new food truck owners to get to know their business intimately from an expense standpoint right from the beginning. The more you understand where your money is going the better you will get at turning an acceptable profit.

If you are a merchant, beginning inventory is the cost of merchandise on hand at the beginning of the year that you will sell to customers. If you are a manufacturer or producer, it includes the total cost of raw materials, work in process, finished goods, and materials and supplies used in manufacturing the goods . These are reductions from list or catalog prices and are usually not written into the invoice or charged to the customer. Do not enter these discounts on your books of account.

You are a direct seller if you meet all the following conditions. If you enter into a lease after August 5, 1997, you can exclude from income the construction allowance you receive from your landlord if you receive it under both the following conditions. Your loss from the injury that you have not yet deducted. If you are the owner of a disregarded entity (for example, a single-member LLC), see Qualified Real Property Business Indebtedness in chapter 1 of Pub. The following discussion covers some exceptions to the general rule for canceled debt. The investment credit is the total of the several credits.